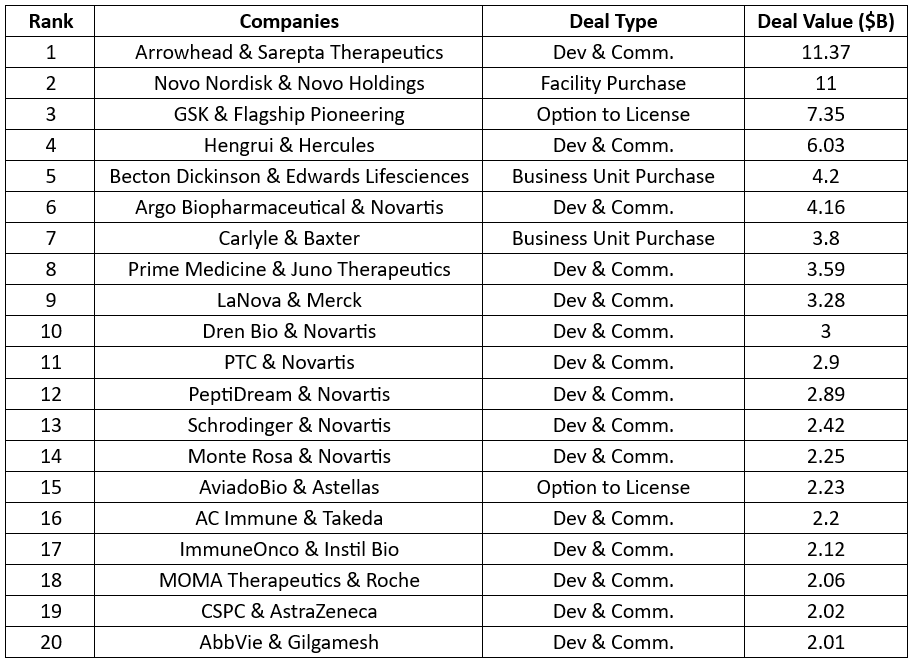

Top 20 Life Sciences Deals of 2024 by Total Deal Value

Shots:

- Life Sciences Dealmaking 2024 outlined a new genre of strategies for shaping global healthcare landscapes by targeting emerging technologies and addressing unmet needs

- In 2024, Arrowhead’s global licensing and commercialization deal with Sarepta Therapeutics for $11.37B ranked first in the list, followed by Novo Nordisk’s facility purchase from Novo Holdings for $11B and GSK’s option to licensing deal with Flagship Pioneering $7.35B

- Leveraging DealForma’s insights, PharmaShots brings an illuminating analysis of Life Sciences Dealmaking in 2024

Note: Columns 1 and 2 represent the rank and companies while Columns 3 and 4 represent the deal type and the total deal value

(Dev & Comm. – Development and Commercialization)

.png)

20. AbbVie Development and Commercial Licensing Deal with Gilgamesh

Deal Date: 13 May, 2024

Deal Value: $2.01B

- AbbVie & Gilgamesh signed an option-to-license agreement to develop neuroplastogens combining AbbVie's psychiatry knowledge & Gilgamesh's research platform

- As per the agreement, Gilgamesh will get $65M upfront and is eligible to receive up to $1.95B as option exercise fee & milestones plus mid-single to low-double net-sales based tiered royalties

- As per the agreement, both companies will research & develop a portfolio of neuroplastogens. AbbVie, upon option exercise, will handle development & commercialization

.png)

19. AstraZeneca Development and Commercial Licensing Deal with CSPC Pharmaceutical

Deal Date: 07 Oct, 2024

Deal Value: $2.02B

- AZ signed an exclusive licensing agreement with CSPC Pharmaceutical Group to develop a novel small molecule disruptor of Lipoprotein (a) for treating dyslipidemia & bolstering its cardiovascular portfolio

- CSPC is entitled to get $100M upfront plus ~$1.92B development & commercialization milestones as well as tiered royalties

- As per the agreement, AZ will develop YS2302018 as a monotherapy or in combination with AZ's AZD0780 (oral small molecule PCSK9 inhibitor) for addressing a wide range of cardiovascular disease indications

.png)

18. MOMA Therapeutics Development and Commercialization Deal with Roche

Deal Date: 04 Jan, 2024

Deal Value: $2.06B

- MOMA Therapeutics granted Roche exclusive, worldwide rights to develop and commercialize therapies using MOMA's KnowledgeBase platform for the treatment of cancer

- MOMA will receive $66M up front and is eligible for up to $2B in development, regulatory, and commercial milestones, plus tiered royalties

- As per the agreement, MOMA will be responsible for development activities through confirmation while Roche will be responsible for further activities. Additionally, MOMA has the right to co-fund the development of one late-stage therapy in exchange for increased royalties in the US

.png)

17. ImmuneOnco Development and Commercialization Deal with Instil Bio

Deal Date: 01 Aug, 2024

Deal Value: $2.12B

- Instil Bio & ImmuneOnco come together to sign a definitive agreement allowing Instil to secure the rights to develop & commercialize ImmuneOnco’s IMM2510 & IMM27M outside Greater China, with ImmuneOnco holding onto the rights across Greater China incl. Taiwan, Macau & Hong Kong

- ImmuneOnco will get $50M upfront & near-term payments plus $2B development, regulatory & commercial milestones along with single-digit to low double-digit percentage royalties on global ex-China sales

- Both IMM2510 & IMM27M have concluded dose-escalation studies in solid tumors. IMM2510 showed responses in squamous NSCLC patients who failed PD-1 inhibitors & IMM27M showed anti-tumor activity & began combination studies with IMM2510 across China in Jul 2024

.png)

16. AC Immune License Option Deal with Takeda

Date: 13 May, 2024

Deal Value: $2.2B

- Takeda & AC Immune signed an exclusive, worldwide option & license agreement to develop ACI-24.060, a clinical candidate for Alzheimer’s Disease and Down Syndrome

- AC Immune will obtain $100M upfront, an aggregate of up to ~$2.1B for development, commercial & sales-based milestones as well as option exercise fee, plus double-digit global net-sales-based tiered royalties

- As per the agreement, AC Immune will conclude the ABATE study, while Takeda will fund and carry out all future clinical development, global regulatory activities & commercialization

.png)

15. AviadoBio License Option Deal with Astellas

Date: 08 Oct, 2024

Deal Value: $2.23B

- Astellas & AviadoBio inked an exclusive option & licensing agreement for AVB-101

- AviadoBio will receive $30M upfront, $20M equity as well as ~$2.18B licensing fees & milestones with additional royalties

- As per the agreement, Astellas gets an option to secure exclusive global rights to develop & commercialize AVB-101 for FTD-GRN & other indications

.png)

14. Monte Rosa Development and Commercialization Deal with Novartis

Date: 28 Oct, 2024

Deal Value: $2.25B

- Monte Rosa and Novartis signed a global license agreement for VAV1 molecular glue degraders, including MRT-6160, currently in P-I trials for immune conditions. Novartis will gain exclusive rights for P-II trials and commercialization, while Monte Rosa will finish the P-I trial

- Monte Rosa will receive $150M upfront, with potential milestones of up to $2.1B beginning upon P-II trials initiation and tiered royalties on non-U.S. sales

- As per the agreement Monte Rosa will co-fund the P-III trial for MRT-6160 in the U.S. and share profits and losses. The deal is subject to regulatory approval. This agreement will help Monte Rosa extend operational runways and utilize the QuEEN discovery engine

.png)

13. Schrodinger Development and Commercialization Deal with Novartis

Date: 12 Nov, 2024

Deal Value: $2.42B

- Schrödinger & Novartis signed a research collaboration & licensing agreement to advance the latter’s drug candidates and also expanded a 3-year software agreement, providing Novartis access to Schrödinger’s computational modeling & drug discovery tech across its research sites

- Schrödinger will receive $150M upfront, up to $892M research, development & regulatory milestones, additional $1.38B commercial milestones plus tiered mid-single-digit to low-double-digit net-sales-based royalties per product commercialized by Novartis

- As per the agreement, the companies will select & advance therapeutics for undisclosed targets in Novartis’s key areas. Both will share discovery efforts, with Novartis handling clinical development, manufacturing & commercialization

.png)

12. PeptiDream Development and Commercialization Deal with Novartis

Date: 30 Apr, 2024

Deal Value: $2.89B

- PeptiDream expanded its partnership with Novartis previously signed in 2019 for the discovery of peptides to be used as peptide-drug conjugate

- Under the partnership, PeptiDream is entitled to receive $180M upfront, $2.71B development, regulatory & commercial milestones along with net-sales-based tiered royalties

- The partnership will leverage PeptiDream’s Peptide Discovery Platform System (PDPS) technology to discover new macrocyclic peptides for Novartis-selected targets to be used in radionuclide conjugation and other therapeutic/diagnostic applications

.png)

11. PTC Development and Commercialization Deal with Novartis

Date: 27 Nov, 2024

Deal Value: ~$2.9B

- PTC & Novartis partnered to develop PTC518 Huntington's disease program, incl. related molecules

- PTC will receive $1B upfront, up to $1.9B development, regulatory & sales milestones plus double-digit tiered royalties on ex-US sales, with a US profit split of 40% (PTC) & 60% (Novartis). Closing is planned in Q1'25

- As per the agreement, Novartis will be responsible for the development, manufacturing, and commercialization of PTC518 after the completion of the ongoing PIVOT-HD study, (expected to occur in H1’25)

.png)

10. Dren Bio Development and Commercialization Deal with Novartis

Date: 24 Jul, 2024

Deal Value: $3B

- Novartis and Dren Bio inked a strategic collaboration to discover and develop therapeutic bispecific antibodies for cancer treatment

- Dren Bio is entitled to receive a total of $150M upfront ($25M equity), $2.85B preclinical, clinical, regulatory & commercial milestones plus tiered royalties

- As per the agreement, the collaboration will leverage Dren Bio’s proprietary Targeted Myeloid Engager and Phagocytosis Platform for advancing targeted myeloid engager programs. Novartis will carry out development, manufacturing, regulatory, and commercialization activities post-selection

.png)

09. LaNova Development and Commercialization Deal with Merck

Date: 14 Nov, 2024

Deal Value: $3.28B

- Merck and LaNova Medicines collaborated to develop the latter’s LM-299 targeting advanced solid tumors

- LaNova will receive $588M upfront plus up to $2.7B milestones related to technology transfer, development, regulatory approval & commercialization, with the closing anticipated in Q4’24

- As per the agreement, Merck gets exclusive worldwide rights for the development, manufacturing & commercialization of LM-299

.png)

Date: 28 Sep, 2024

Deal Value: $3.59B

- Prime Medicine & BMS entered into a strategic research collaboration and licensing agreement to develop reagents for next generation ex vivo T-cell therapies

- Prime Medicine is entitled to receive $55M upfront & $55M equity investment along with an aggregate of >$3.5B milestones, incl. ~$185M preclinical, ~$1.2B development & >$2.1B commercialization milestones, plus net-sales-based royalties

- As per the agreement, Prime Medicine will develop optimized Prime Editor reagents using its PASSIGE technology for select targets while BMS will handle development, manufacturing & commercialization of next-gen cell therapies, with support from Prime Medicine

.png)

07. Carlyle Business Unit Purchase with Baxter

Date: 13 Aug, 2024

Deal Value: $3.8B

- Baxter International and Carlyle entered into a definitive agreement and the transaction is anticipated to conclude in H2’24 or H1’25

- Baxter will receive an aggregate of $3.8B ~$3.5B in cash from the deal, estimated ~$3B after-tax proceeds, and the remaining will be used for working capital and debt adjustment

- As per the agreement, Carlyle will acquire Baxter's Vantive Kidney Care segment for Vantive Kidney Care segment provides products and services for peritoneal dialysis, hemodialysis, and organ support therapies such as continuous renal replacement therapy (CRRT)

.png)

06. Argo Biopharmaceutical Development and Commercialization Deal with Novartis

Date: 07 Jan, 2024

Deal Value: $4.16B

- Argo Biopharmaceutical entered into multi-program RNAi Licenses and Strategic Collaborations with Novartis

- Argo will receive $185M up front and is eligible for up to $3.98B in option exercise fees, development, regulatory, and commercial milestones, plus undisclosed tiered royalties

- As per the agreement, Argo Biopharmaceutical granted Novartis exclusive, worldwide rights to develop and commercialize a P-I RNA-based therapy with an option for up to 2 additional therapies for treating cardiovascular diseases. Additionally, Novartis has exclusive, worldwide rights to develop and commercialize (excluding China) P-I/IIa therapy

.png)

05. Becton Dickinson Business Unit Purchase Deal with Edwards Lifesciences

Date: 03 June, 2024

Deal Value: $4.2B

- BD agreed to acquire Edwards Lifesciences’ Critical Care product group, strengthening its portfolio of smart connected care solutions

- BD will fund $1B in cash and $3.2B in new debt with net leverage of about 3x at closing, with plans to reduce it to 2.5x within 12-18mos. using free cash flow. The transaction is contingent upon customary regulatory reviews and closing conditions and will conclude at YE’24, summing up to a $4.2B deal in cash

- As per the agreement, the acquisition will further add Critical Care's AI & ML-based gold-standard Swan Ganz pulmonary artery catheter, minimally invasive sensors, noninvasive cuffs, tissue oximetry sensors & monitors to BD’s portfolio, enabling improved decision-making capabilities

.png)

04. Jiangsu Hengrui Development and Commercialization Deal with Hercules (now Kailera Therapeutics)

Date: 17 May, 2024

Deal Value: $6.03B

- Hengrui Pharmaceuticals entered into a licensing agreement with Hercules Pharmaceuticals

- Hengrui will receive $100M upfront and acquire a 19.9% equity stake in Hercules and is eligible for $10M in near-term payment upon technology transfer, $200M in development and regulatory milestones, and $5.75B in sales milestones, plus royalties ranging from low single digits to low double digits

- As per the agreement, Jiangsu Hengrui Pharmaceuticals granted Hercules worldwide exclusive rights excluding Greater China to develop and commercialize three glucagon-like peptide-1 (GLP-1) therapies HRS-7535, HRS9531, and HRS-4729

.png)

03. GSK Option to License Deal with Flagship Pioneering

Date: 29 Jul, 2024

Deal Value: $7.35B

- GSK & Flagship Pioneering partnered to discover & develop new therapies & vaccines for respiratory & immunology diseases by combining GSK’s knowledge in disease areas & development with Flagship’s ecosystem of bioplatform companies (incl. new modalities & tech)

- Flagship & its bioplatform companies will obtain ~$720M upfront, development & commercial milestones plus preclinical funding & tiered royalties for each acquired candidate

- As per the agreement, both will invest ~$150M upfront to explore promising concepts for R&D through Flagship’s bioplatform companies, building a portfolio of 10 novel therapies & vaccines; GSK gets the exclusive option for further advancement of these candidates

.png)

02. Novo Nordisk Facility Purchase Deal with Novo Holdings

Date: 29 Jul, 2024

Deal Value: $11B

- Novo Nordisk purchased Catalent's fill-finish sites located in Anagni (Italy), Brussels (Belgium), and Bloomington (Indiana, US) from Novo Holdings

- Novo Holdings received $11B up front representing enterprise value for the sites, certain corporate assets, and liabilities attributable to the acquired business

- The sites specialize in the sterile filling of drugs in connection with Novo Holdings' acquisition of Catalent

.png)

01. Arrowhead Development and Commercialization Deal with Sarepta Therapeutics

Date: 26 Nov, 2024

Deal Value: $11.37B

- Arrowhead Pharmaceuticals signed a global licensing and collaboration agreement with Sarepta Therapeutics for several clinical and preclinical programs

- Arrowhead to get $825M upfront ($500M cash + $325M equity), $250M in annual tranches ($50M for 5yrs.), $300M on complete enrolment of P-I/II in 12mos., ~$10B milestones ($110-$410M development + $500-$700M sales milestones per program) & low double-digit tiered royalties

- As per the agreement, in the next 5yrs., Sarepta will select 6 targets in CNS or muscle for development and commercialization whereas, Arrowhead will handle the discovery, preclinical, and manufacture of clinical drug supply for them & for 4 commercial products currently in clinical trials

Sources:

- Press releases

- OANDA

- Company Websites

- DealForma

Related Post: Top 20 Life Sciences Deals of 2023 by Total Deal Value

Tags

An avid reader and a dedicated learner, Prince works as a Content Writer at PharmaShots. Prince possesses an exceptional quality of breaking down the barriers of words by simplifying the terms in digestible chunks to make content readable and comprehensible. Prince likes to read books and loves to spend his free time learning and upskilling himself.